Let's start a metal prediction market

. . .

James Surowiecki’s The Wisdom of Crowds is a book I recommend to everyone. In it, he posits that groups of people, under the right conditions, will make better decisions than individual people. (See the book’s Wikipedia entry for those conditions.) One of his examples is guessing the number of jellybeans in a jar. If the conditions are right, a group of people will guess the number, on average, more accurately than any one member of the group. (See book excerpt here.)

I’ve run two versions of the jellybeans-in-a-jar game on this site. The first was guessing the price of an Iron Maiden shirt. The second was guessing which band did which audio clip (Hinder, Edguy, or Sentenced). In both cases, you guys did miserably. According to Surowiecki, this would be due to one or more failures of crowd intelligence. Perhaps you guys are too smart (analytics state that most of you are college-educated) and thus think too alike. Or perhaps the structure of the comments box leads to an information cascade, in which your guesses are influenced by previous ones that you see. Or perhaps there just aren’t enough of you to constitute a meaningful data set. (Tell your friends about Invisible Oranges!)

In his book, Surowiecki discusses a phenomenon that could be applied to metal (or anything, really). That phenomenon is the prediction market. Prediction markets are markets that handle predictions (natch). Your office Super Bowl pool would be one example. However, I have little interest in professional sports that don’t involve men beating the shit out of each other. (It’s OK if a puck is involved.)

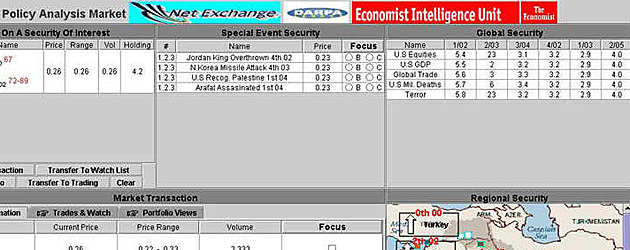

I am interested in real world events, though, and prediction markets exist for them. At Hollywood Stock Exchange, you can bet play money on TV and movie events like awards and opening box office grosses. The US Department of Defense (DOD) once developed a prediction market called FutureMAP that would handle predictions on events in the Middle East. The idea was to harness collective intelligence for more accurate geopolitical predictions. You can see a partial screenshot of it below. In it, you can see the categories for trading – stock activity, GDP, global trade, US military deaths, and terror – as well as specific events to be predicted, like the assassination of Yasser Arafat by the first quarter of ’04 and the overthrow of Jordan’s king by the fourth quarter of ’02. People would have bet real money on these events, with the DOD paying out the winnings. (See details here, here, and here.) Unsurprisingly, this raised a shitstorm of negative publicity, and the project was canned.

. . .

. . .

Probably the most prominent prediction market in real-life, non-sports events is Intrade.com. Political elections are natural fodder for this market, though spicier events like Lindsay Lohan posing for Playboy have also been the subject of betting (at least on Intrade’s play money site, Intrade.net). The market prices range from 0 to 100, with each point representing 10 cents. Here’s how it works: if you buy a contract for an event, at, say, 60 – that is, you find a seller selling it at 60 – and the event occurs, it pays out 100 minus 60 = 40, which is $4 per contract. If the event does not occur, the payout is zero. (People bet real money at Intrade.com, which is incorporated in Ireland and evidently thus escapes the jurisdiction of US gambling laws.) Given the 0-100 range, the market price of an event represents the probability that it will happen, as predicted by the market. For example, Intrade.com currently forecasts a 95.2% likelihood that Elana Kagan will be sworn in as the next US Supreme Court justice, and a 25% likelihood that Sarah Palin will be the Republican Presidential nominee in 2012.

I’m proposing a prediction market for metal (but with play money). Would people be interested? The more people that participate, the more accurate the market’s predictions would be. Inkling Markets has a 45-day free trial for setting up a prediction market. (I don’t know what the cost would be beyond that, but I’d look into it if the market proved popular enough.) People would bet play money on whether events in metal would happen. One example from the past: “Guns ‘n’ Roses’ Chinese Democracy released after China achieves democracy”. Another in the future: “Slayer’s next studio album is their last”. A market lasting 45 days would necessarily be limited in its predictions (first week sales numbers, perhaps), but we’d cross that bridge when we got there.

Are any of you traders? Would any of you be willing to administer such a market?

Even if this metal prediction market never gets off the ground, it’s still fun to brainstorm events to bet on. They must have a definite yes-no result: either they happen or they don’t. So, heading off people’s first inclinations, they can’t be along the lines of “Morbid Angel’s next album will suck”. That’s a subjective measure. But “Morbid Angel releases new album by December 31, 2010” would be a valid event for prediction.

What metal events would you bet on? I’ll lead off with a few. And, of course, if you’re interested in participating in a metal prediction market, say so in the comments. It could be fun.

1. Roadrunner drops Grand Magus after one album.

2. Isis’ next studio album is their last.

3. Record labels stop making CD’s by December 31, 2015.

4. Godflesh records new music by December 31, 2011.

5. Anthrax does not release new music by December 31, 2011.